Now Reading: AI in Finance: How AI is Transforming Financial Services

-

01

AI in Finance: How AI is Transforming Financial Services

AI in Finance: How AI is Transforming Financial Services

Overview of AI in Financial Services

Artificial intelligence has moved from a niche capability into a core driver of value across financial services. Institutions are leveraging AI to sift through vast oceans of transactional data, market feeds, and customer interactions to uncover patterns that were previously invisible. The result is not only faster decision making but decisions that are more informed, consistent, and scalable across geographies and product lines. In a competitive market, AI-enabled capabilities translate into improved efficiency, better risk management, and differentiated customer experiences. At the same time, firms must navigate regulatory expectations, data privacy considerations, and the ongoing need to maintain robust governance around model behavior and outcomes.

- Advanced fraud detection and prevention powered by machine learning models trained on historical and real-time data.

- Automated customer service through chatbots and virtual assistants that handle routine inquiries and triage complex requests.

- Risk scoring, credit underwriting, and operational decision support driven by predictive analytics and scenario testing.

- Regulatory reporting, anomaly detection, and governance enhancements to support compliance programs.

- Personalization and pricing optimization enabled by granular customer insights and behavioral analytics.

For financial app development, integrating AI requires a disciplined approach to data quality, model lifecycle, and cross-functional collaboration. Banks and fintechs invest in data pipelines, feature stores, and telemetry to monitor model health while aligning with governance, security, and privacy standards. The outcome is a more responsive product, a clearer view of risk, and the ability to adapt quickly to shifting market conditions. As AI adoption scales, the emphasis shifts from isolated use cases to end-to-end platforms that support multiple lines of business with consistent standards.

AI-Driven Fraud Detection and Compliance

Fraud detection and financial crime compliance stand among the most tangible and high-stakes AI use cases in finance. Machine learning models analyze patterns across millions of transactions, devices, and network signals in near real time, looking for anomalies that deviate from established baselines. Behavioral analytics help distinguish legitimate activity from potentially fraudulent actions, enabling faster interventions and reducing losses. At the same time, AI augments regulatory programs by enhancing KYC/AML processes, automating screening, and supporting auditability through persistent, explainable decision records. The combination of speed, scale, and transparency is critical to maintaining trust with customers and regulators alike.

- Real-time anomaly detection and pattern recognition across payment rails, card networks, and login behaviors.

- Supervised learning models trained on known fraud signatures to improve accuracy and reduce false positives.

- Unsupervised and semi-supervised approaches to discover novel fraud schemes without extensive labeled data.

- Device fingerprinting, geolocation, and network telemetry to strengthen authentication and risk scoring.

- Explainability, audit trails, and versioned model governance to satisfy regulatory scrutiny and internal controls.

Operationalizing AI for fraud and compliance requires robust data governance, ongoing data quality assessments, and vigilant monitoring. Organizations must manage trade-offs between speed and precision, tune thresholding to minimize customer friction, and maintain human oversight for high-stakes decisions. Privacy considerations, data minimization, and secure data handling practices are essential to protect customer trust while enabling the analytical insights that reduce risk across the enterprise.

Algorithmic Trading, Personalization, and Risk Management

Algorithmic trading, robo-advisory services, and personalized banking experiences are being transformed by AI-driven insights and optimization. In trading, AI-enabled strategies analyze streaming market data, sentiment signals, and macro indicators to identify opportunities across equities, fixed income, and derivatives. The focus is on speed, resilience, and risk controls, with models constrained by market microstructure, latency budgets, and regulatory requirements. In personal finance, robo-advisors interpret client goals, risk tolerance, and time horizons to construct diversified portfolios and adjust allocations in response to changing market conditions. Across both domains, AI supports more granular risk assessment, scenario analysis, and stress testing, helping institutions quantify potential losses and prepare capital plans under a wide range of events.

- Algorithmic trading strategies, including statistical arbitrage, trend-following, and mean-reversion signals, guided by robust risk controls.

- Robo-advisory platforms that tailor asset allocation, tax optimization, and retirement planning to individual client profiles.

- Personalization of product recommendations, pricing, and service interactions based on deep customer insights.

- Comprehensive risk scoring, scenario testing, and capital allocation optimization to support prudent decision making.

- Governance and model risk management to monitor performance, detect drift, and ensure compliance with market rules.

Adoption in this area requires attention to latency, data integrity, and interpretability. Traders and risk managers rely on transparent models with clear performance metrics and alerting that allows rapid intervention. It also demands scalable infrastructure, robust monitoring, and a disciplined change-management process to keep models aligned with evolving market regimes and regulatory expectations.

Implementation Considerations for Financial App Development

When building financial apps that leverage AI, a holistic data strategy is foundational. This includes data sourcing, quality controls, cataloging, lineage tracking, and privacy-preserving access controls. Strong data governance ensures that models are trained on representative, unbiased data and that outcomes are auditable. Security is non-negotiable, with encryption in transit and at rest, robust identity management, and clear policies for data retention and access. Compliance teams must align AI initiatives with industry regulations, including AML, KYC, privacy laws, and sector-specific rules, while engineering teams focus on scalable, observable, and maintainable systems. A clear model lifecycle, from development to deployment to retirement, is essential to maintain reliability and reduce risk over time.

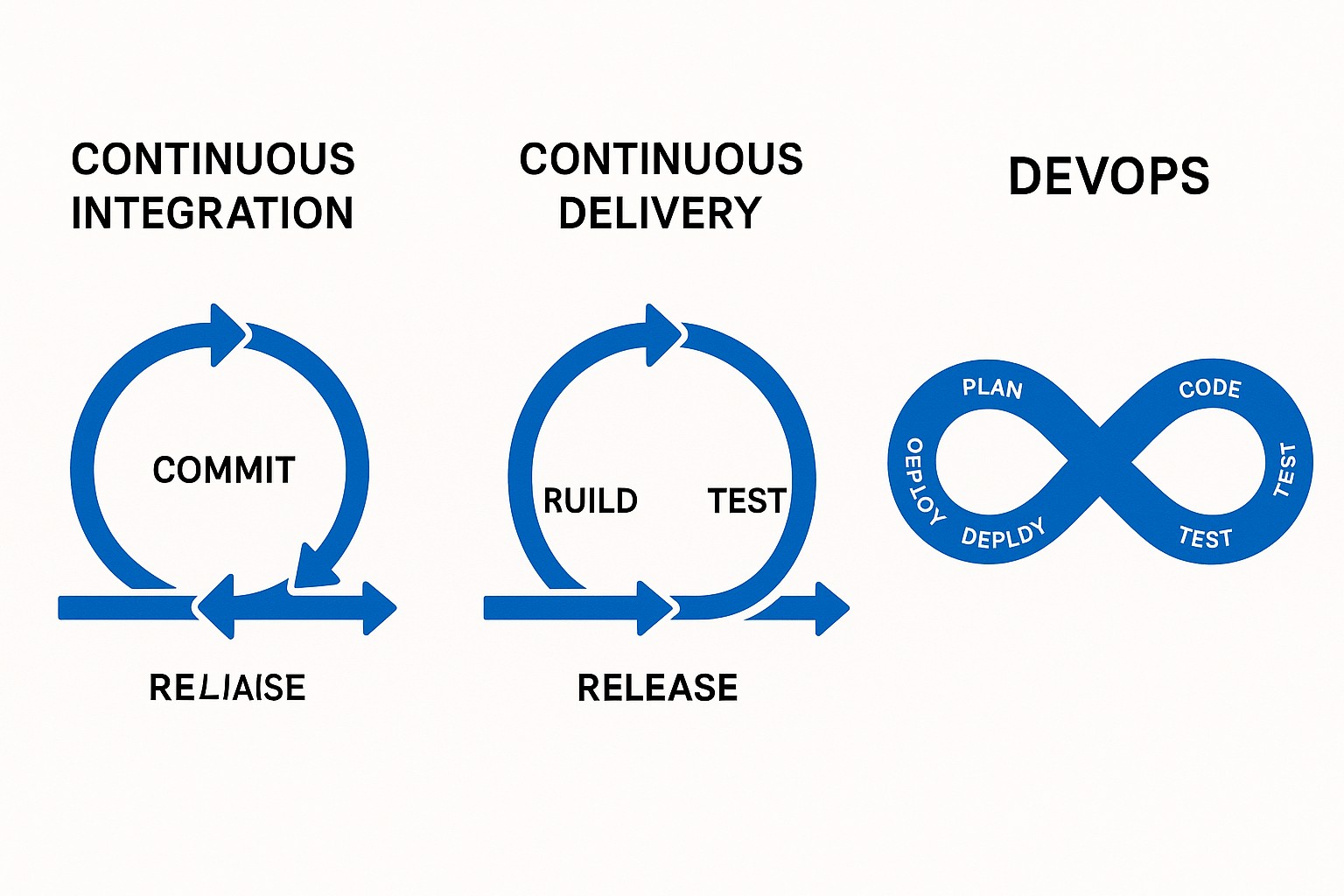

Architecturally, successful AI-enabled financial apps typically adopt modular, service-oriented designs with well-defined interfaces, feature stores, and robust monitoring. Teams implement MLOps practices to manage model versioning, automated testing, canary releases, and performance dashboards. Cross-functional collaboration between data scientists, engineers, product, risk, and compliance is critical to ensure that models deliver business value without introducing unintended consequences. Given the cost and complexity of AI initiatives, organizations often pursue phased rollouts, starting with high-impact, low-risk use cases and gradually expanding to more sophisticated capabilities while maintaining strict governance and cost controls.

Future Trends and Opportunities

Looking ahead, finance will see continued advances in privacy-preserving machine learning, such as federated learning and secure multi-party computation, which enable analytics across institutions without exposing sensitive data. Synthetic data generation may help augment training datasets, improve model robustness, and reduce the risk of data leakage. Edge AI could enable faster fraud detection at the point of sale or device authentication in mobile banking, while regulatory tech (RegTech) will leverage AI to automate compliance workflows, simplify reporting, and enhance audit readiness. Governance frameworks and explainability standards will mature, helping institutions justify model decisions to customers and regulators. The convergence of AI with cloud-native architectures, real-time data streams, and open banking ecosystems will accelerate innovation while heightening the need for resilient security and robust risk management.

From a business perspective, AI-enabled financial services will continue to unlock efficiency gains, personalized experiences, and new revenue streams. Firms will increasingly measure success through end-to-end impact, including process improvements, customer satisfaction, risk-adjusted returns, and regulatory compliance metrics. Strategic considerations will emphasize talent development, responsible AI practices, and the alignment of AI initiatives with organizational goals and ethical standards. As technology evolves, the most successful institutions will blend advanced analytics with disciplined governance to deliver scalable, trustworthy AI across all lines of business.

FAQ

What are the main AI use cases in finance today?

Today’s primary AI use cases in finance span fraud detection and risk management, automated customer service, algorithmic trading and robo-advisory services, credit underwriting and pricing optimization, and regulatory compliance support. Across these areas, AI enables real-time decision making, personalized customer experiences, and scalable processing of vast data volumes. The most successful implementations combine strong data governance, explainable models, and robust monitoring to sustain performance and trust over time.

How does AI improve fraud detection without sacrificing user experience?

AI improves fraud detection by leveraging rapid, data-driven analysis that distinguishes legitimate activity from anomalous patterns with high precision. To preserve user experience, systems are designed to minimize false positives, implement adaptive thresholding, and incorporate contextual signals such as device information and geolocation. Human-in-the-loop reviews for ambiguous cases, coupled with explainable AI that clarifies why a decision was made, helps balance security with convenience, reducing friction while maintaining strong protection.

What are the key challenges of deploying AI in financial services?

Key challenges include ensuring data quality and governance, managing model risk and drift, meeting privacy and regulatory requirements, and integrating AI into legacy technology stacks. Operational challenges involve building scalable MLOps processes, achieving explainability, controlling costs, and maintaining security across complex, multi-cloud environments. Organizational factors such as cross-functional collaboration, change management, and talent acquisition also play critical roles in successful deployment.

How does AI impact risk management and regulatory compliance?

AI enhances risk management by providing more granular, forward-looking insights, improving stress testing, and enabling faster scenario analyses. For regulatory compliance, AI supports automated monitoring, suspicious activity detection, and comprehensive audit trails. The impact depends on robust governance—clear model documentation, explainability, versioning, and continuous validation—to ensure models behave predictably and within established risk appetites and legal constraints.

What should a financial app development team consider when adopting AI?

Teams should prioritize a solid data strategy, including quality controls and data lineage, along with a governance framework for model risk and ethics. Security and privacy must be embedded from the outset, with strong protections for data in transit and at rest. Architecturally, adopt modular, observable systems with clear ownership, implement MLOps for lifecycle management, and establish metrics that tie AI outcomes to business value. Finally, cultivate collaboration across product, risk, compliance, and technology groups to ensure responsible and scalable AI implementation.