Now Reading: Developing a Custom POS System: Key Considerations

-

01

Developing a Custom POS System: Key Considerations

Developing a Custom POS System: Key Considerations

Executive Overview

Developing a custom Point-of-Sale (POS) system is a strategic investment that goes beyond software selection. It requires aligning technology with business processes, manufacturing demand for resilience, and a clear plan for how data flows across front-end interactions, back-office operations, and third-party services. A well-executed POS platform can reduce transaction times, improve inventory accuracy, and enable insightful decision-making through real-time analytics. The objective is not to replicate a generic solution but to build a system that evolves with your business model, supports omnichannel operations, and remains maintainable as requirements change.

To achieve this, teams must consider a structured set of decisions around hardware compatibility, payment processing, data architecture, security, and deployment. The following sections outline the core considerations, practical trade-offs, and implementation patterns that organizations typically confront when moving from a manual or semi-digital storefront to a purpose-built POS ecosystem. The emphasis is on pragmatic design choices, open standards, and sustainable governance that can scale with growth and adapt to regulatory developments.

Hardware Integration

Hardware choice anchors reliability and user experience. In addition to the core terminal, a modern POS must support peripheral devices, connectivity options, and recover gracefully from network interruptions. Decisions here influence upfront costs, maintenance burden, and the speed at which store teams can complete transactions. It is important to design for both initial rollout and long-term expansion, including multi-site deployments and potential reconfiguration in response to seasonal demand patterns.

Key considerations include the form factor of terminals, the durability of devices in a retail environment, and the ease with which accessories can be added or replaced. Planning for offline or intermittent connectivity ensures that sales continue even when network reliability is imperfect. A well-chosen hardware stack also simplifies field support and reduces the time to resolve issues, which in turn improves customer service levels and staff productivity.

- POS terminals and form factors (tablets, compact all-in-one devices, desktop-style terminals) that match staff workflows and store footprints

- Peripheral devices such as barcode scanners, receipt printers, cash drawers, scales, and signature capture tools

- Connectivity options (Wi-Fi, Ethernet, cellular backup) and reliability requirements for uninterrupted operations

- Battery life, heat management, and ergonomic design to support long shifts and varied store layouts

- Hardware procurement, warranty coverage, serviceability, and upgrade paths over time

- Compatibility with security standards and driver ecosystems to minimize integration friction

Software Architecture and Data Model

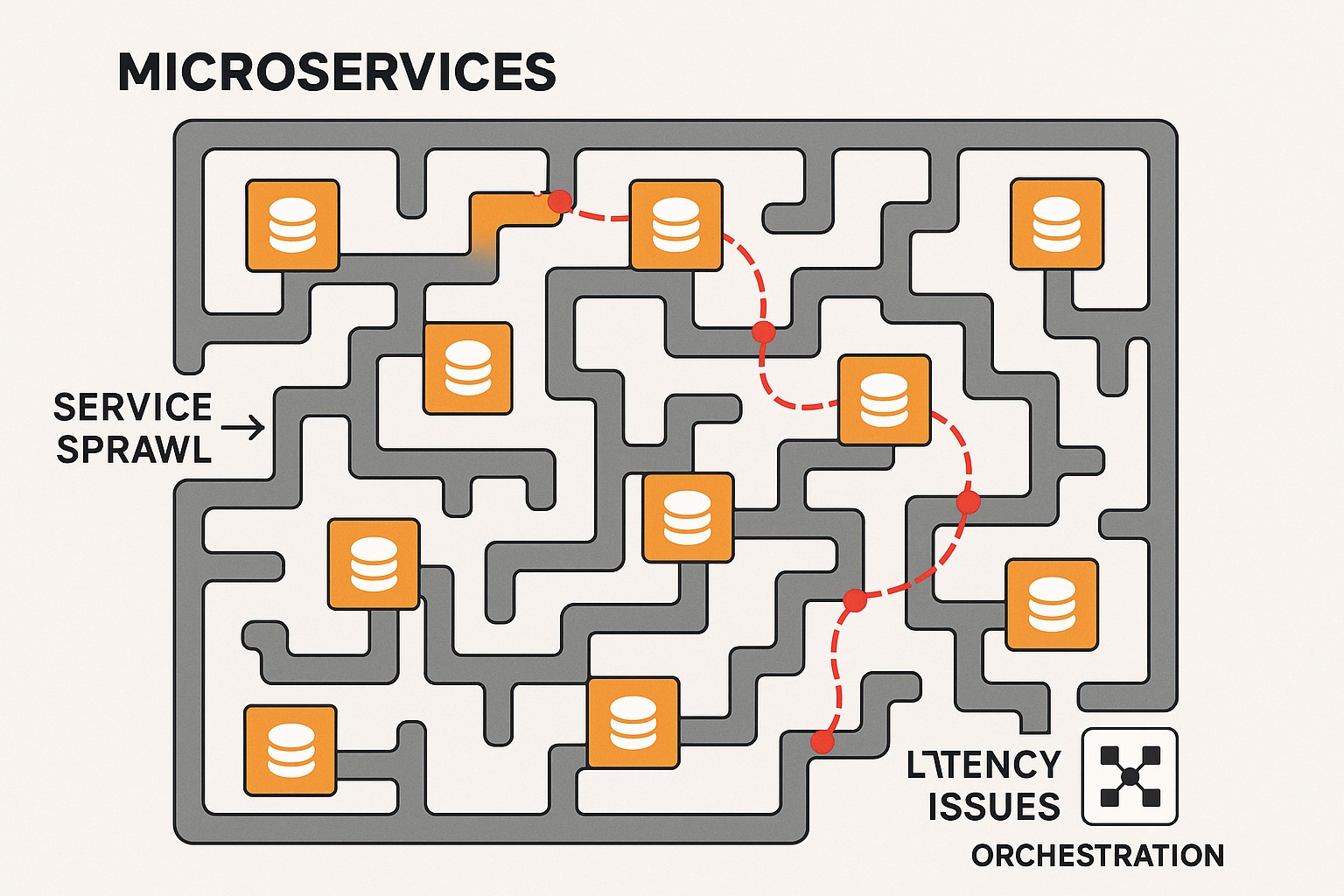

A robust POS software architecture emphasizes modularity, scalability, and maintainability. A well-defined data model supports real-time transaction processing, inventory synchronization, and customer data management across channels. Distinct layers help isolate concerns, enable parallel development, and simplify testing. For example, presentation logic should remain decoupled from business rules and data access, while external integrations should be managed through clearly defined interfaces or events to mitigate coupling and promote resilience.

In practice, teams should design for eventual consistency where necessary, while ensuring that critical transactional paths remain strongly consistent. A careful approach to event handling, idempotency, and audit trails reduces the risk of double-entry errors and data corruption during high-velocity checkout periods. Documentation of data contracts and schema evolution strategies is essential so that teams can coordinate changes across front-end apps, back-office systems, and third-party services without introducing breaking changes.

| Layer | Responsibilities | Example Technologies |

|---|---|---|

| Presentation | User interface and interaction flow for cashiers and managers; accessibility considerations | React, Vue, Angular |

| Business Logic | Checkout rules, discounts, taxes, promotions, loyalty processing | Java Spring Boot, Node.js |

| Data Access | Persistence layer, caching strategies, transactional boundaries | PostgreSQL, MongoDB |

| Integration/Services | APIs, event streams, external system connectors | REST, GraphQL, Kafka |

Payment Processing, Security, and Compliance

Payment processing is the heartbeat of a modern POS, with security and compliance as non-negotiable requirements. The design must balance speed and reliability with risk management and regulatory obligations. Decisions around gateways, tokenization, and payment method support shape the user experience on the floor and the solidity of financial controls in the back office. A disciplined approach to security reduces exposure to data breaches and improves customer trust, while a well-defined compliance posture minimizes audit friction and keeps operations aligned with industry standards.

Operational teams should emphasize data minimization, encryption in transit and at rest, and robust access controls. Clear responsibilities for tokenization, PCI scope management, and vendor risk assessments help keep the system secure without sacrificing performance. Planning for future payment methods, such as mobile wallets or contactless transfers, ensures the POS can adapt as consumer preferences evolve and as new processor interfaces become available.

- PCI DSS compliance and scope management to minimize sensitive data exposure

- Payment gateway integration versus direct processor connections based on cost, latency, and feature needs

- Tokenization, data minimization, and end-to-end encryption for sensitive information

- Fraud detection, anomaly monitoring, and risk scoring integrated into the transaction flow

Inventory Management and Integrations

Inventory accuracy is a foundational capability that enables correct stock visibility, replenishment, and order fulfillment. A custom POS should support real-time or near-real-time stock updates, stock-take processes, and multi-location visibility. Integrations with warehouse management systems, purchasing modules, and e-commerce platforms help close the loop between storefronts and back-office operations, reducing stockouts and overstock conditions. A thoughtful design also accommodates batch and serial tracking where relevant, and supports rules for automatic replenishment based on demand signals.

Beyond core inventory control, the system should enable flexible product structures, including variants, bundles, and promotions that directly impact stock levels and pricing. The ability to attach metadata to items (vendor data, lot numbers, expiration dates) improves traceability and informs compliance requirements in regulated sectors. Effective integration with external systems—whether ERP, CRM, or marketplace channels—depends on stable APIs, clear data contracts, and sustainable change management processes.

User Experience, Reporting, and Analytics

A POS system is only as valuable as its ability to translate transactions into actionable insights. A clean, fast, and intuitive operator interface reduces training time and errors, while thoughtful reporting unlocks performance visibility for store leadership and corporate teams. The reporting layer should balance near-term operational dashboards with longer-term analytics that support strategic decisions, such as assortment planning and promotional effectiveness. Role-based views ensure that managers, cashiers, and back-office staff see only what they need to perform their duties.

In practice, organizations benefit from dashboards that combine sales, inventory, labor, and customer engagement data into coherent narratives. The design should allow ad-hoc analysis, scheduled reports, and automated alerts that notify stakeholders about anomalies or opportunities. A well-scoped analytics strategy also defines data retention policies, privacy protections, and governance practices to maintain data quality across locations and channels.

- Sales and channel performance dashboards for rapid decisions

- Inventory turnover, stock-out risk, and replenishment metrics

- Labor productivity, shift coverage, and throughput analysis

- Exception reporting, alerts, and audit trails for compliance and operational integrity

Deployment, Maintenance, and Support

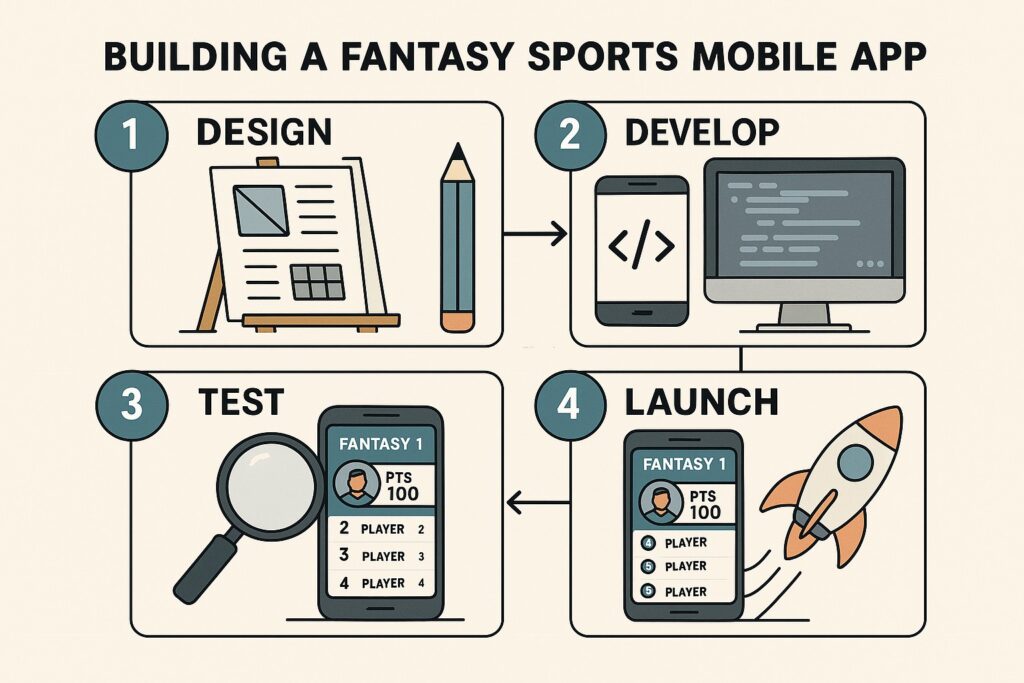

Deployment planning requires a phased approach that minimizes disruption to store operations. A staged rollout, test environments, and pilot sites help validate performance, user acceptance, and integration reliability before broader implementation. Ongoing maintenance includes regular software updates, remote monitoring, disaster recovery planning, and clear incident response procedures. A governance model that assigns ownership, defines service-level targets, and documents escalation paths reduces risk and accelerates issue resolution.

Operational stability also hinges on a robust data backup strategy, secure configurations, and clear change management processes. Training programs should be designed to evolve with the software, equipping store teams to adopt new features without sacrificing day-to-day efficiency. When combined with a support model that emphasizes proactive monitoring and rapid remediation, a custom POS can deliver durable value across multiple store formats and growth scenarios.

Strategic Considerations: Scalability, Open Standards, and Roadmap

Looking ahead, scalability should be a primary design criterion. The architecture should accommodate additional locations, new payment methods, expanded product catalogs, and more complex promotions without a complete rewrite. Open standards and well-documented APIs reduce vendor lock-in and enable smoother integration with future services, be they analytics platforms, ERP systems, or omnichannel marketplaces. A clear product roadmap helps align business goals with technical milestones, ensuring investments remain relevant as market conditions shift and competition intensifies.

In addition to technical scalability, governance around data privacy, security audits, and compliance updates must adapt to evolving regulations. Strategic partnerships with payment processors, device manufacturers, and software vendors can create a resilient ecosystem that accelerates time-to-value while preserving flexibility. A disciplined approach to roadmap prioritization—balancing immediate operational gains with longer-term strategic bets—helps organizations realize sustained improvements in efficiency, customer satisfaction, and profitability.

What are the core features a custom POS should include?

A robust POS should support fast checkouts, accurate inventory updates, customer management, discounts and promotions, loyalty programs, and reporting. It should also offer offline capability for uninterrupted service, role-based access control for security, and a straightforward path for onboarding new staff. Integrations with payment processors, ERP or inventory systems, and e-commerce channels help maintain data consistency across touchpoints and channels.

How should hardware integration be planned to avoid bottlenecks?

Plan around staff workflows and environmental conditions, selecting devices with the right balance of performance, durability, and ease of maintenance. Ensure peripherals have reliable drivers and standardized connectors, and design for network resilience with fallback options such as cellular connectivity. Create a maintenance plan that covers warranties, spare parts, and field-service capabilities to minimize downtime during peak periods.

What are the key security and compliance considerations?

Prioritize data minimization, encryption for data in transit and at rest, robust access controls, and regular security audits. Define PCI DSS scope clearly and implement tokenization for payment data. Establish incident response procedures, vendor risk assessments, and a policy for software updates to mitigate vulnerabilities without disrupting operations.

How can data architecture support real-time reporting and offline operations?

Use a design that supports both online and offline modes, with local persistence for critical paths and asynchronous replication to back-end systems when connectivity resumes. Ensure transactional integrity with idempotent operations and clear conflict resolution rules. A well-structured data model and event-driven integration enable real-time dashboards while preserving data accuracy across locations and channels.

What factors influence total cost of ownership and deployment timeline?

Key drivers include hardware investments, software development and integration efforts, ongoing maintenance, licensing or subscription costs, and the scale of multi-site deployment. Timeline depends on stakeholder alignment, data migration complexity, vendor readiness, and change management efficacy. A phased rollout with measurable milestones typically yields the most predictable outcomes and enables early validation of ROI through early wins.