Now Reading: Blockchain in Finance: The Rise of DeFi

-

01

Blockchain in Finance: The Rise of DeFi

Blockchain in Finance: The Rise of DeFi

Blockchain in Finance: An Overview

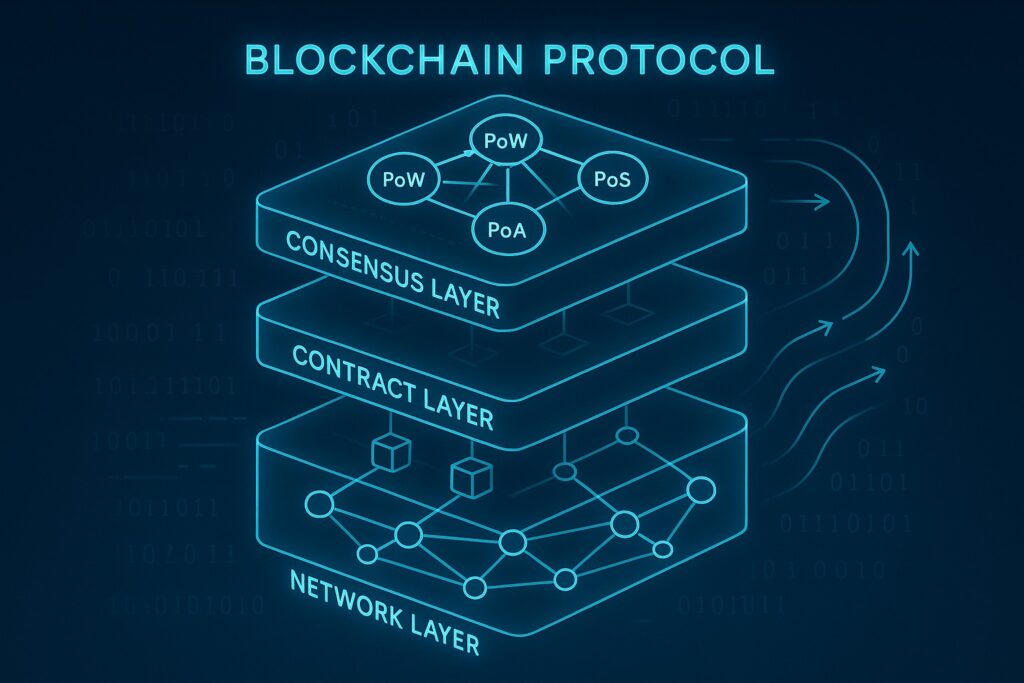

Blockchain technology has evolved from a niche infrastructure to a mainstream platform for financial services. Built on cryptographic consensus and distributed ledgers, blockchain enables trustless settlement, transparent audit trails, and programmable logic via smart contracts. In finance, this translates into faster settlement times, reduced counterparty risk, and new forms of liquidity. In practice, institutions are piloting cross-border payments, trade finance, and syndicated lending using blockchain rails, seeking to lower friction and increase transparency across complex value chains. The geographic reach of finance, combined with the velocity of digital markets, creates demand for systems that can operate with high assurance while remaining auditable and accessible to a diverse set of participants. As with any transformative technology, the path to scale brings questions about governance, interoperability, and regulatory alignment that institutions are actively addressing through pilots, standards work, and layered risk management.

Decentralized finance (DeFi) has emerged as a software layer of interconnected protocols that replicate traditional financial services without relying on a centralized intermediary. Smart contracts encode terms for lending, borrowing, trading, asset management, and insurance; these contracts self-execute when predefined conditions are met. The composable nature of DeFi—often described as money legos—lets protocols plug into one another, creating complex financial arrangements with minimal human intervention. This design offers unparalleled openness and accessibility: anyone with an internet connection and a compatible wallet can participate, permissionlessly, subject to the protocol’s rules and the underlying asset risk. Conventional finance tends to be limited by geographic licensing, counterparty risk, and capital controls; DeFi broadens inclusion by removing some of these frictions, though it also introduces new concerns around governance, upgradability, and oracle security. As institutions and retail participants experiment, the emphasis shifts to security engineering, user experience, and risk disclosures that align with institutional expectations and consumer protections.

- Immutability and verifiability of on-chain records

- Programmable money and composable services via smart contracts

- Global, permissionless liquidity pools

- Transparent, auditable governance and fee models

- Programmable risk parameters and automated liquidations

DeFi architecture and core components

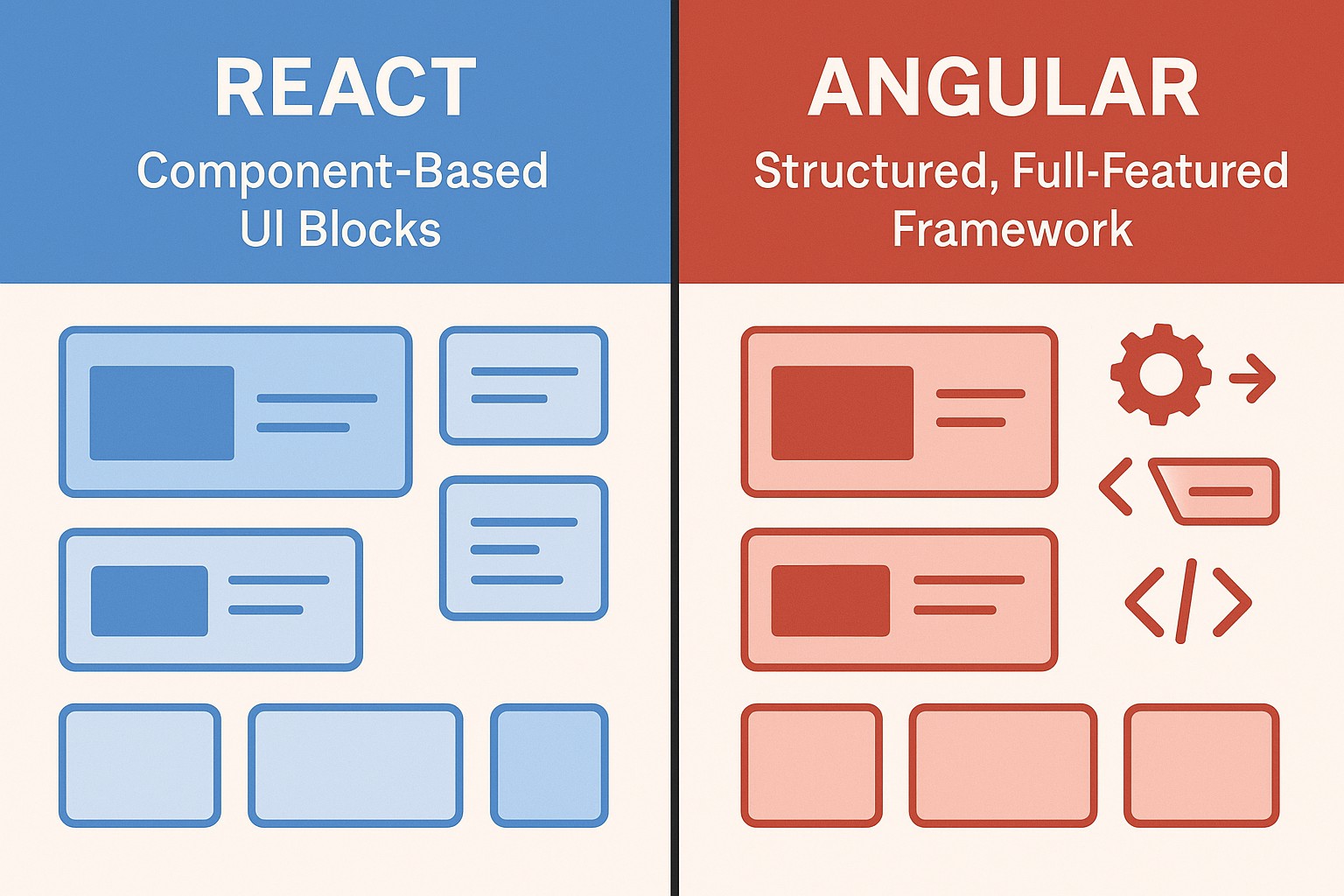

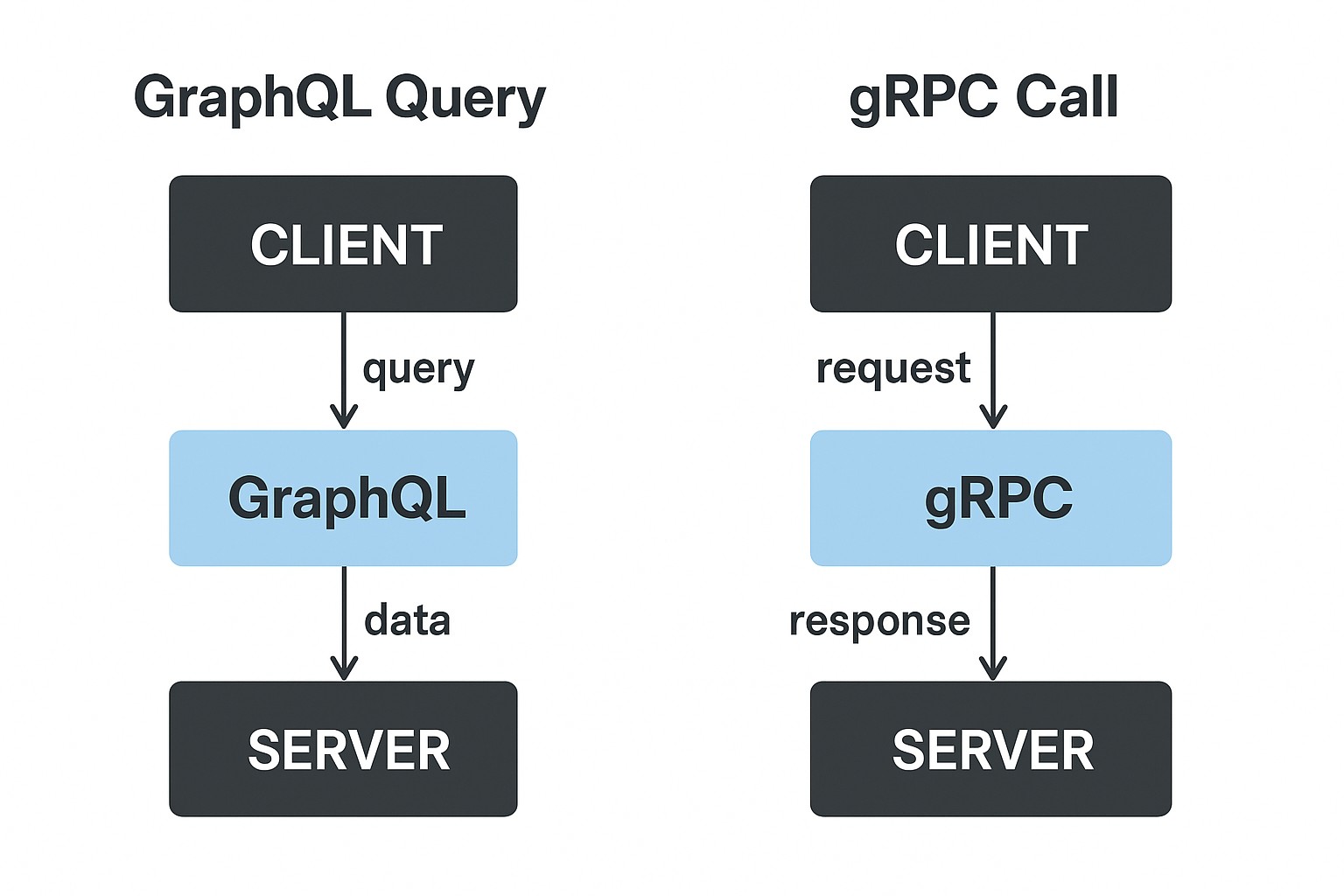

At a high level, DeFi relies on smart contracts deployed on blockchain networks, user wallets, and front-end applications. Core components include on-chain lending pools, decentralized exchanges, collateralized debt positions, oracles for external data, and liquidity aggregators. These primitives are designed to operate with verifiable outcomes, where the execution of financial terms—such as interest accrual, collateral checks, and liquidations—happens automatically according to the code. The separation of concerns between custody, settlement, and governance enables rapid iteration, while maintaining a transparent on-chain trail that participants can audit.

Layered architecture in DeFi supports modular development and cross-chain interoperability. Smart contracts provide the core logic, while wallets and identity solutions offer user access and control. Oracles supply price feeds and external data to on-chain protocols, and bridges or cross-chain messaging protocols enable assets and signals to move between networks. This modularity accelerates experimentation, but it also requires rigorous security practices, including formal verification, extensive testing, and robust governance processes to manage upgrades and parameter changes. The accessibility of DeFi has driven a rich ecosystem of developer tools, auditing firms, and standardized interfaces that help operators compare risk profiles and performance across protocols. Below is a minimal code fragment illustrating how a contract might expose a simple function scenario within this ecosystem.

// Example: a minimal Solidity function to transfer tokens

function safeTransfer(address recipient, uint256 amount) external returns (bool) {

// imagine checks and transfer logic here

return true;

}

Lending and borrowing in DeFi

Lending protocols enable users to supply assets and earn interest, while borrowers draw against collateral without traditional credit checks. Interest rates are typically algorithmic, driven by supply and demand within the pool, and the system uses collateralization ratios to protect lenders against default risk. When markets move and collateralization dips below risk thresholds, automated liquidations can occur to restore solvency. The design space includes pure peer-to-peer lending, overcollateralized pools, and more advanced strategies that combine collateral types, credit scoring through on-chain data, and dynamic risk parameters. For participants, these mechanics translate into opportunities to earn yield or access capital in a permissionless, auditable environment—and also into responsibilities to monitor collateral risk and exposure to price volatility.

Key protocol archetypes cover a spectrum from simple interest-bearing deposits to highly automated, risk-managed debt positions. The ecosystem continues to evolve with governance-driven parameter changes, insurance solutions, and layered risk controls designed to adapt to market conditions. In practice, users often assess liquidity depth, slippage resilience, and the soundness of collateral assets before committing capital to a pool or vault.

- Aave

- Compound

- MakerDAO

- Yearn Finance (yield strategies)

Decentralized exchanges and yield farming

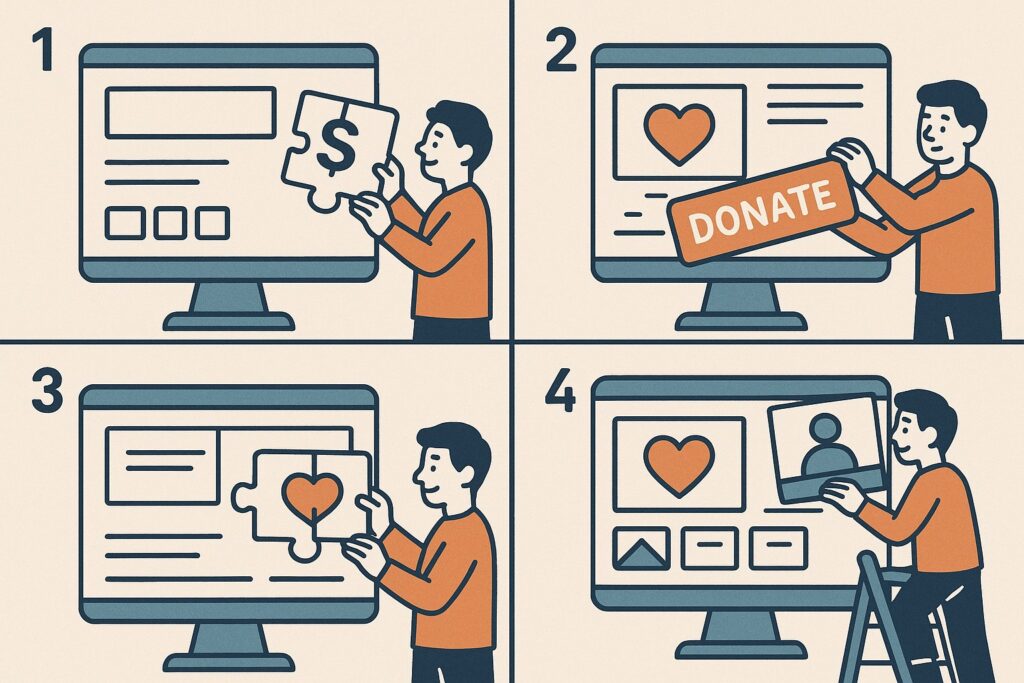

Decentralized exchanges (DEXs) replace central order books with automated market makers and liquidity pools, enabling direct peer-to-peer trading without intermediary custody. Traders supply token pairs to pools and receive trading fees proportional to their liquidity share. The price of assets in AMMs is determined by a constant product formula and other mathematical constructs, which creates market efficiencies but also introduces the concept of impermanent loss when relative asset prices diverge. Yield farming expands on this by allowing participants to provide liquidity to pools or stake tokens to earn rewards, often in the form of native protocol tokens. While yield farming can amplify returns, it also carries liquidity risk, contract risk, and exposure to token inflation if reward mechanisms are highly incentivized. Practitioners must weigh feverish incentives against long-term fundamentals and the potential for volatility in governance and tokenomics.

For participants seeking to engage, the workflow typically involves selecting pools with adequate liquidity, ensuring wallet compatibility, and understanding the fee structure and potential impermanent loss. The flexibility and openness of these markets have attracted a broad base of users, from seasoned traders to curious newcomers, but success depends on careful risk assessment and ongoing monitoring of protocol health and market conditions.

- Connect your wallet

- Choose a protocol and pool

- Deposit assets to provide liquidity

- Stake LP tokens to earn rewards

- Harvest rewards and manage impermanent loss

Regulation, security, and risk management

Regulatory approaches to DeFi vary by jurisdiction and tend to evolve as markets mature. Authorities examine issues such as investor protection, anti-money-laundering controls, tax treatment of tokenized assets, and the categorization of tokens as securities or commodities. The borderless nature of DeFi presents challenges for traditional regulatory models, prompting ongoing dialogue among policymakers, industry participants, and standard-setting bodies about appropriate disclosure, conduct risk, and breach responses. At the same time, many DeFi projects implement self-regulatory measures such as transparent governance, time-locked upgrades, and bug bounty programs to reduce systemic risk and align incentives with long-term resilience.

Security and risk management are central to sustaining trust in DeFi. Audits, formal verification, and continuous monitoring help identify vulnerabilities, while diversified exposure across multiple protocols can reduce single points of failure. Robust governance, multi-signature controls, and prudent treasury management further mitigate operational and governance risk. In practice, users should apply a comprehensive risk framework that considers smart contract risk, oracle reliability, liquidity depth, and macro market dynamics, and that aligns with their risk appetite and regulatory obligations.

| Risk type | Description | Mitigation |

|---|---|---|

| Smart contract risk | Code bugs or exploits in protocol logic | Regular audits, formal verification, bug bounty programs, diversified usage |

| Oracle risk | Data feeds may be manipulated or fail during stress | Multiple independent oracles, robust aggregation, fallback mechanisms |

| Liquidity risk | Inability to execute trades or withdraw funds without significant slippage | Liquidity depth monitoring, prudent pool selection, use of conservative parameters |

| Governance risk | Protocol decisions may alter risk profile or introduce regression | Transparent processes, time-locks, community review, and pause mechanisms |

What is DeFi and how does it differ from traditional finance?

DeFi refers to decentralized finance built on blockchain networks using smart contracts to provide financial services without central counterparties. Unlike traditional finance, where a bank or intermediary custody assets or conduit transactions, DeFi relies on code and on-chain settlement, which can operate 24/7 and with programmable terms. Intermediaries are replaced by protocols governed by token holders or community members, and risk and governance are embedded in the protocol itself. The absence of centralized supervision increases transparency and resilience in some scenarios, but also places greater emphasis on security engineering, user education, and clear risk disclosures.

Are DeFi platforms safe and reliable?

DeFi platforms can be highly secure in design, thanks to cryptography, formal guarantees, and open-source review; however, they also carry notable risks, including smart contract bugs, oracle manipulation, liquidity shocks, and governance missteps. Security has improved through audits and community-led risk controls, yet incidents have occurred. Reliability often hinges on protocol maturity, liquidity depth, and ongoing governance discipline. Users should assess a protocol’s audit history, community activity, and instrument risk, and should consider diversified exposure and prudent position sizing.

How can beginners start with DeFi?

Beginners should start with foundational education on wallet management, private keys, and the basics of on-chain assets. Start with small amounts on reputable, well-audited protocols, focusing on straightforward use cases such as lending or savings streams before exploring more complex strategies. Use test networks or simulated environments when possible, keep track of gas costs, and avoid overexposure to a single asset or protocol. Joining community channels and seeking guidance from experienced users can also help build confidence while learning best practices for security and risk management.

What regulatory challenges surround DeFi?

Regulatory challenges center on classification of tokens, investor protection, consumer disclosures, and enforcement across borders. Jurisdictions are examining whether certain DeFi activities resemble traditional financial services that require licensing, capital requirements, or anti-fraud safeguards. Policymakers are also focused on preventing illicit activity, promoting transparency, and ensuring platform resilience. The regulatory landscape is evolving, and firms participating in DeFi typically monitor developments, engage with regulators, and implement controls that align with applicable laws while preserving core innovation principles.

What are the main risks and how can they be mitigated?

The primary risks include smart contract vulnerabilities, price oracle failures, liquidity constraints, and governance-related changes that could affect protocol reliability. Mitigation involves a layered approach: prefer protocols with multiple audits and formal verification, employ diversified exposure across protocols, monitor oracle health and price feeds, practice prudent treasury and risk management, and participate in governance processes that provide checks and balances. Complementary protections such as insurance coverage, bug bounty programs, and clear disclosure of risk can further enhance resilience while allowing participants to engage with DeFi more confidently.